Conservative and Protected plays

What are the "conservative" and "protected" data tables at CoveredCalls.com?

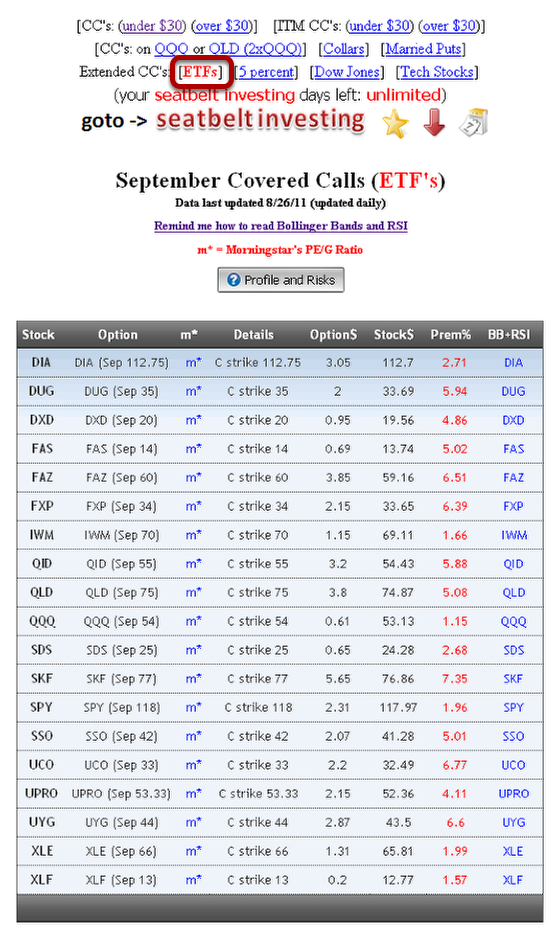

1. ETF's

ETF stands for "Exchange Traded Fund" and they are one of the most popular investment vehicles today.

They are are great way to sell covered calls (CC's) because the underlying ETF, which trades like stock, has built-in diversification.

Unlike a stock (which represents a single company), an ETF represents multiple companies, and is a broader representation of the market.

The diversification of an ETF helps to curb volatility, and provides you with more protection (as compared to the risk exposure of a single company stock).

CC premiums on ETF's range from about 1% per month to upwards of 6% per month, depending on volatility.

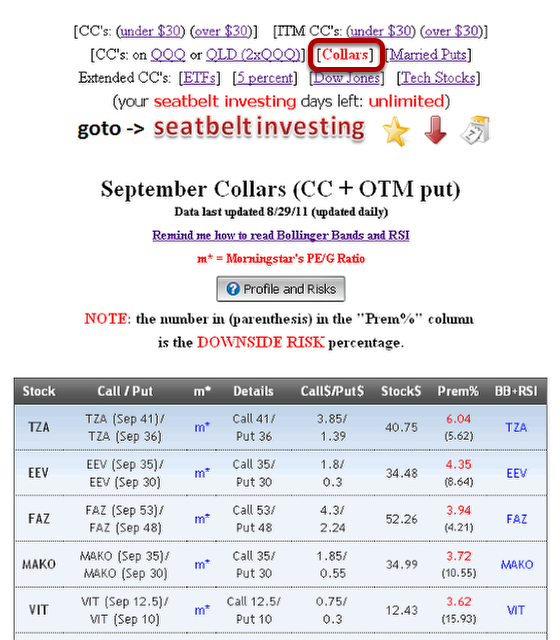

2. Collars

A "Collar" is a strategy that has both limited risk and limited reward.

Normally when you construct a Collar, you:

- Buy stock

- Sell call (OTM)

- Buy put (OTM)

The put option that you buy is a type of "insurance" for the stock.

And, normally, you buy the put option out-of-the-money (OTM) in a Collar.

Net returns on Collars (after accounting for the cost of the put insurance) varies from about 2% to 6% per month.

Risk on Collars can be anywhere from about 5% to 18% maximum risk.

For your convenience, we calculate and show you both the NET return and the max risk, to help you evaluate potential plays quickly.

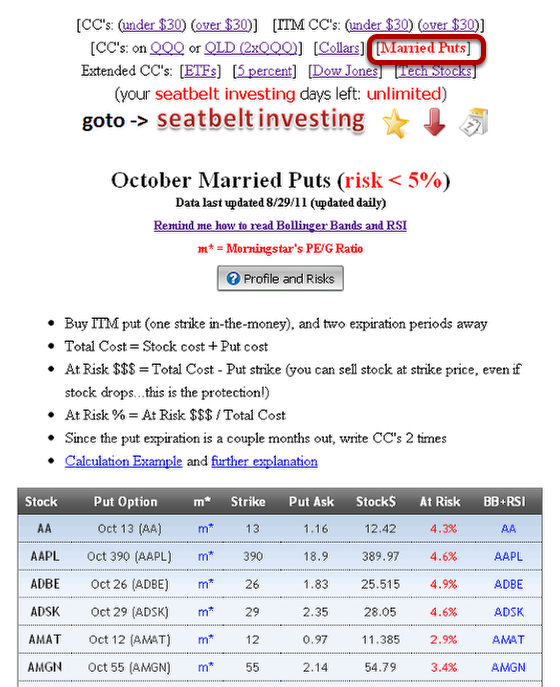

3. Married Puts

Married Puts is a strategy where you buy a put option at the SAME time you buy the stock.

In other words, the put is "Married" to the stock.

The put option acts as real insurance on the stock position.

The Married Put differs from the Collar in that the put option purchased for the Collar is "out-of-the-money" (OTM) while the put option purchased in the Married Put is "in-the-money" (ITM).

The ITM put is more expensive (than the OTM put), but the ITM put provides MUCH stronger protection.

For example, an OTM put risk profile might have a max risk of 15%, but the ITM put limits risk to less than 5%.

The Married Put play is the foundational strategy for our "seatbelt investing" (SBI) service.