CC Hedge-fund with the QLD QID Combo

The QLD/QID "Hedge Fund" is one of our advanced topics.

This topic is covered in our GEM's Video Training modules.

The QLD and QID are inversely-related ETF's (one goes up, the other goes down).

If you pair the QLD + QID combo together, they mirror each other (protect each other).

Then you can write CC's against the self-protecting hedge.

Below are the short summary steps for the QLD/QID "Hedge Fund".

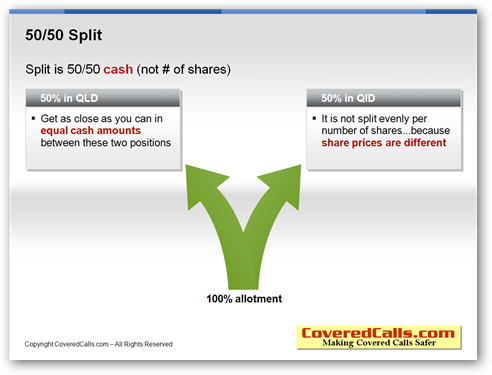

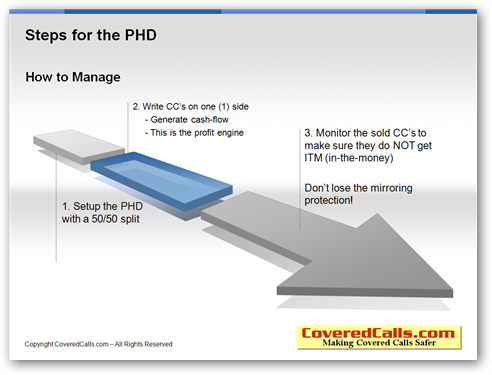

1. Split your risk capital 50/50 (QLD/QID)

- Virtual trade (paper trade) new strategies first, until you learn how they work!

- Split your risk capital 50/50 (QLD/QID) by *dollar-value* (NOT by number of shares).

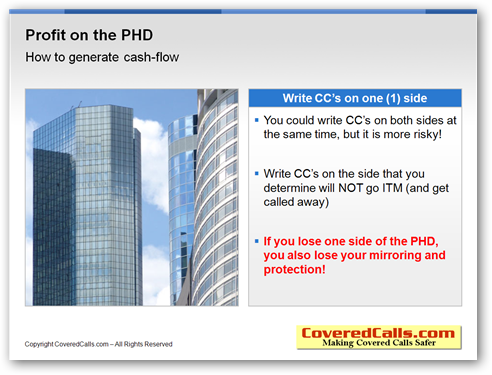

2. Write CC's only on ONE (1) side at a time

You write CC's on the side (per your technicals indicators) you feel will NOT go ITM (and get called out).

By only writing CC's on one side at a time, you reduce the risk of having a side going ITM.

3. You do NOT want one side to go ITM and get called out

If one side does go ITM and get called out, that can wipe out profits and increase risk (by losing the mirroring/protecting hedge).

Trying to buy-back the ITM call is expensive, and will also wipe-out profits.

That is why you want to avoid (at all costs) having one side ITM.